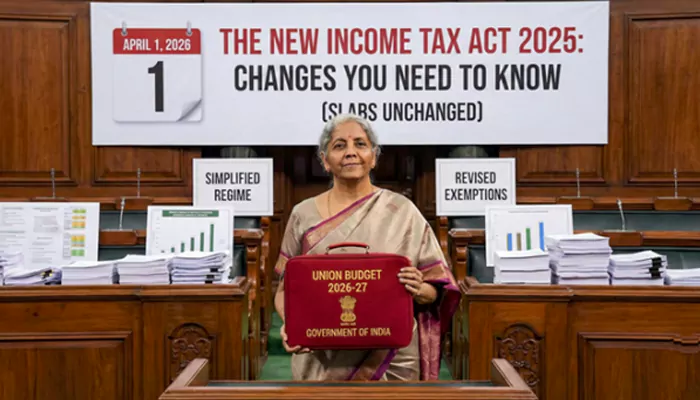

Union Budget 2026-27 : The New Income Tax Act 2025 - April 1 Changes You Need to Know (Even If Slabs Didn't Move)

- Soham Halder

- 3 weeks ago

- 3 minutes read

The slabs stayed put, but the rulebook just got shredded. Here’s why your CA is panicking.

Everyone loves a good numbers game. We tune in, breathless, hoping the Finance Minister tosses us a bone - maybe a tweaked slab here, a higher deduction there. Yesterday? Crickets. The slabs for the 2026-27 fiscal year haven’t budged an inch. Boring, right?

Wrong.

While we were busy staring at the unchanged rates, the government quietly pulled the rug out from under the entire system. Come April 1, the Income Tax Act of 1961 is history. Dead. Kaput. Replacing it is the shiny, terrifyingly efficient New Income Tax Act, 2025. And honestly? This changes everything more than a 5% rate cut ever could.

The "Simplicity" Trap

They’re selling it as "simplification." That’s the buzzword, isn’t it? The new forms are supposedly so easy a fifth-grader could file them. But here’s the thing - and I’ve seen enough budgets to know this - simplicity often masks rigidity. Under the old 1961 Act, we had decades of case laws, loopholes, and "grey areas" that a smart Chartered Accountant could navigate.

The New Act wipes that slate clean.

It’s streamlined, yes. But it’s also binary. The ambiguity is gone. Which means if you’re used to creative accounting or pushing the boundaries on expenses, you’ve got nowhere to hide. The new "pre-filled" forms aren't just a convenience; they're a statement. We know what you earned. Don't try to tell us otherwise.

April 1: The Day the Music Dies

The biggest shift is procedural. Section 139 is getting a facelift. The penalty for non-compliance isn't just financial anymore; it’s reputational. The new "compliance score" metric hinted at in the fine print? That’s the stuff of nightmares. It feels a bit like they’re gamifying tax collection, except the only prize is not getting a notice.

And let’s talk about the specific wording on "digital assets." The definitions in the new Act are broad. Uncomfortably broad. If you thought the 2022 crypto tax was harsh, wait until you see how they’ve baked "virtual intangible assets" into the core definitions of income. No more debating if it’s capital gains or business income. The Act decides for you.

So, What Now?

Look, I’m not saying panic. But stop looking at the tax calculator. The math hasn’t changed, but the physics have.

You need to sit down with your financial advisor - not in March, but now - and ask: "How does the New Act define my income sources?" Because assuming the old rules apply is the fastest way to walk into a buzzsaw.

The 1961 Act was a dinosaur, sure. But at least we knew how to dance with it. This new beast? We’re all learning the steps in real-time. And the music starts April 1.