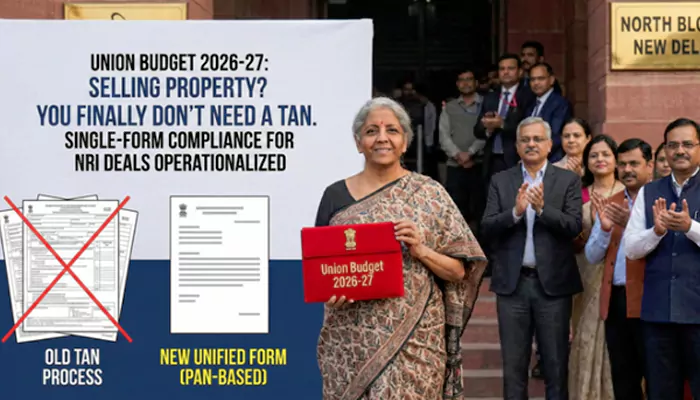

Union Budget 2026-27 : Selling Property? You Finally Don’t Need a TAN

- Devyani

- 3 weeks ago

- 3 minutes read

The Finance Minister has operationalized the 'Single-Form Compliance' for NRI property deals, effectively ending the TAN era for homebuyers.

The Union Budget 2026-27 has delivered a significant procedural update for the real estate sector, specifically for those purchasing property from Non-Resident Indians (NRIs). While the conversation around "Ease of Living" often feels abstract, yesterday’s announcement offers a concrete solution to a decade-old compliance hurdle.

The Finance Minister proposed that resident individuals and Hindu Undivided Families (HUFs) purchasing immovable property from NRIs will no longer be required to obtain a Tax Deduction and Collection Account Number (TAN).

Effective October 1, 2026, these transactions can be reported using the buyer's Permanent Account Number (PAN), mirroring the simplified process currently used for resident-to-resident sales.

A Long-Awaited Rationalization

For years, the disparity in compliance requirements has created friction in the secondary real estate market.

Under the existing framework, a buyer purchasing a flat from a resident seller (where the value exceeds ₹50 lakh) simply deducts 1% TDS and files a simple challan using their PAN. However, if the seller is an NRI, the process shifts to Section 195. This previously mandated that the buyer - often a regular individual with no other tax obligations - apply for a TAN, deduct tax at the rates in force (typically 20% plus surcharge), and file quarterly returns.

The 2026 Budget proposal effectively dismantles this dual structure for individuals. By amending Section 203A, the government has acknowledged that requiring a separate tax registration for a one-off property transaction was an unnecessary procedural bottleneck.

How the New System Will Work

According to the Budget Memorandum, the operational shift will be streamlined as follows:

- Unified Reporting: The Central Board of Direct Taxes (CBDT) is expected to notify a new or modified challan-cum-statement that accommodates NRI sellers.

- The 'Residency' Toggle: Buyers will likely select the seller's residential status on the portal. If 'Non-Resident' is selected, the system will allow the transaction to proceed using the buyer’s PAN, while prompting for the higher tax rate applicable to NRIs.

- Timeline: The amendment is scheduled to take effect from the third quarter of this fiscal year (October 1, 2026), giving the tax department time to update the TRACES software infrastructure.

- Critical Nuance: Liability Remains Unchanged

While the procedure has been simplified, tax experts caution that the fiscal responsibility remains stringent.

"The removal of TAN is a procedural relief, not a tax concession," explains a senior partner at a Delhi-based CA firm. "Buyers must remain aware that purchasing from an NRI still attracts a much higher withholding tax - usually 20% plus surcharge and cess - compared to the 1% for resident sellers. The liability to deduct the correct amount still rests entirely with the buyer."

If a buyer mistakenly treats the transaction as a domestic one (deducting only 1%) because the forms look similar, they could still face demand notices for the shortfall.

Market Impact

The real estate industry has welcomed the move, predicting it will unlock liquidity in the NRI segment. Many buyers were historically hesitant to engage with NRI sellers due to the perceived complexity of obtaining a TAN and filing specific returns.

By moving to a PAN-based system, the government has essentially leveled the playing field, which is likely to encourage faster closures of resale inventory held by NRIs in key markets like Mumbai, Bengaluru, and Gurugram.