Trump Targets Senior Citizen Relief: How Ending Taxes on Social Security Could Transform Retiree Finances

- Devyani

- 1 year ago

- 4 minutes read

A few weeks after former US President Donald Trump pledged to eliminate taxes on tips, he has yet again proposed a new tax relief plan for senior citizens, a key demographic voting bloc. On Wednesday, Trump posted: “SENIORS SHOULD NOT PAY TAX ON SOCIAL SECURITY!” on Truth Social. Let’s understand the impact of the elimination of this tax on senior citizens.

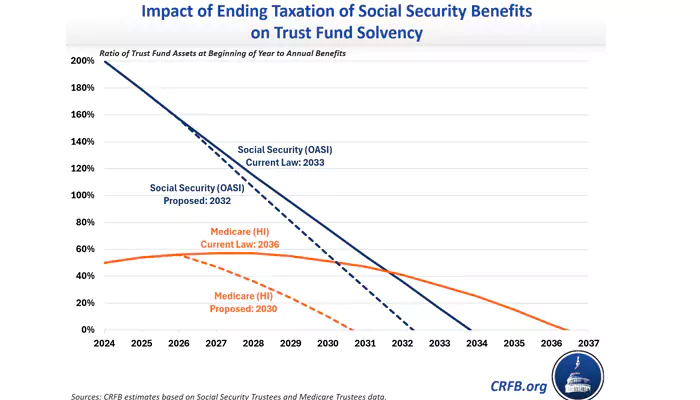

Potential Impact of Trump's Tax Relief Proposal on Social Security and Medicare Funding

According to Marc Goldwein, senior policy director at the Committee for a Responsible Federal Budget, even though lifting the levy will provide temporary relief to many older Americans, the proposal could hurt Social Security, Medicare, and the federal budget unless Trump and Congress discover a solution to restore the lost revenue. Goldwein noted that senior citizens would be vulnerable to reduced benefits if Social Security and Medicare trust funds are depleted. He said, “While seniors might benefit in the short term, the proposal could accelerate the insolvency of Social Security and Medicare and increase the need for broad cuts.”

In a recent interview which aired on Sunday, Trump recapitulated his promise to eliminate taxes on Social Security benefits. However, he could not provide any detail on how he would pay for the revenue losses. When questioned by Maria Bartiromo of Fox News, Trump suggested retrenching “waste” and “fat” from the federal budget but did not state the areas which would be affected.

(Date provided by Committee for a Responsible Federal Budget- CRBF.org)

In response to a major federal overhaul which would strengthen the program, Social Security Benefits was levied in 1984 and continues to experience the same measures. To incorporate any tax law changes, the approval of Congress is needed.

Impact of Eliminating Social Security Tax on Program Sustainability and Senior Benefits

As of today, senior Citizens, whose combined income is below $25,000 for individuals and below $32,000 for couples, do not owe taxes on their Social Security Benefits. Combined income takes into account the senior citizens’ adjusted gross income, nontaxable interest and half of Social Security benefits. If their income surpasses the mentioned threshold, then the senior may be taxed on up to 50% of their benefits. The revenue earned goes to the Social Security Retirement Trust Fund.

Senior citizens who have combined incomes of at least $34,000 per individual, and $44,000 per couple, will be taxed up to an additional 50% on their benefits. These funds will contribute to Medicare’s hospital insurance trust fund (Medicare Part A).

..webp)

The levy on Social Security Benefits is not a significant revenue generator as it does very little to boost the Social Security Trust Fund. However, its contributions have witnessed a surge in recent years due to rising benefits, especially amid high inflation. According to the committee, this year it is estimated that the tax will generate approximately $94 billion.

As per the findings of a committee analysis, eliminating this tax can add between $1.6 trillion- $1.8 trillion to federal deficits through the year 2035. This change would lead to the depletion of the Social Security Trust Fund over a year earlier, while the Medicare hospital insurance trust fund would run dry six years earlier.

As of now, it is predicted that the Social Security Retirement Trust Fund will be exhausted by 2033, possibly only covering 79% of the benefits. As per the latest reports from Medicare trustees, starting in 2036, the health insurance program is expected to be able to pay 89% of the total scheduled Part A benefits.

As noted by Goldwein, once the Social Security Trust Fund runs out, senior citizens, specifically those in the lower-income group, may face a sharp decline in benefits that exceeds their tax savings.

Although taxation on Social Security benefits is hugely disliked by senior citizens, Max Richtman- the CEO of the National Committee to Preserve Social Security and Medicare has strongly expressed his opposition to the elimination of these taxes. He supports adjusting the income threshold for inflation, as proposed in the stalled Social Security 2100 Act.